Are Trust Wills A Good Idea For Your Estate Planning?

Living Trusts Explained In Under 3 Minutes

Keywords searched by users: Are trust wills a good idea what is better, a will or a trust, does a will override a trust, will vs trust chart, why trust is better than a will, wills and trusts for dummies, will vs trust vs estate, who needs a trust instead of a will, average cost of a will and trust

What Are The Disadvantages Of A Will Trust In Uk?

The disadvantages of utilizing a Will Trust in the UK are significant and warrant careful consideration. When you rely on a Will Trust, your assets are consolidated into one or several trusts upon your passing. It’s crucial to understand that for taxation purposes, these consolidated trusts are treated as a single entity by the tax authorities. This can lead to various tax implications that you should be aware of. Consequently, it’s essential to comprehensively assess the potential tax consequences associated with the consolidation of assets in a Will Trust when planning your estate in the UK.

Is It Better To Have A Will Or A Trust Uk?

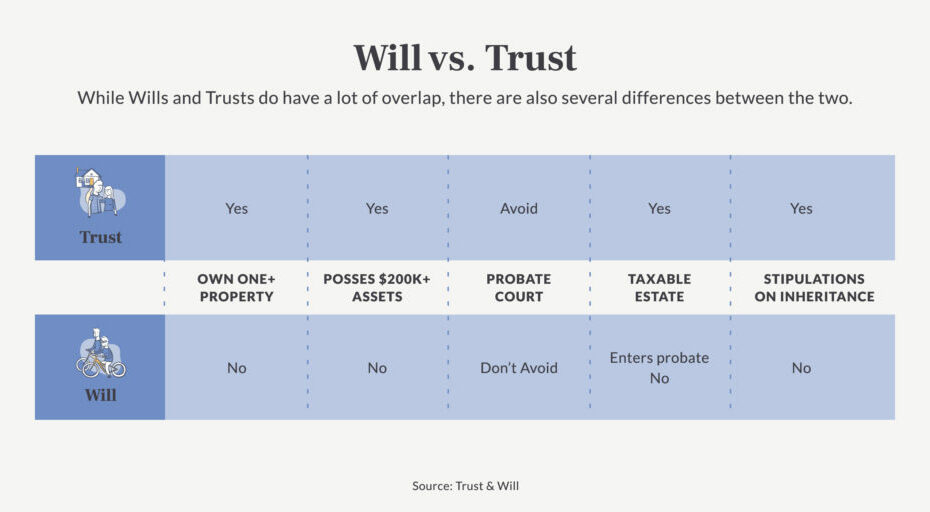

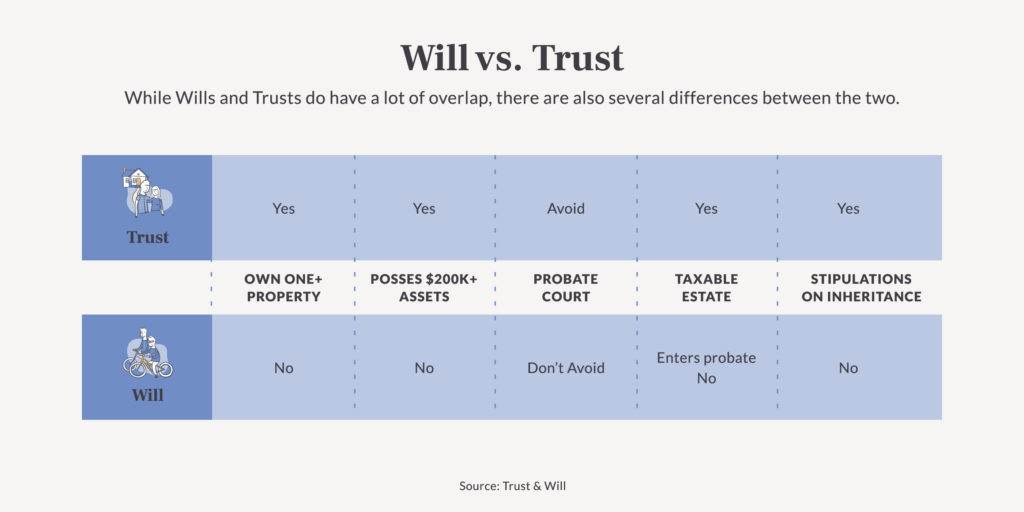

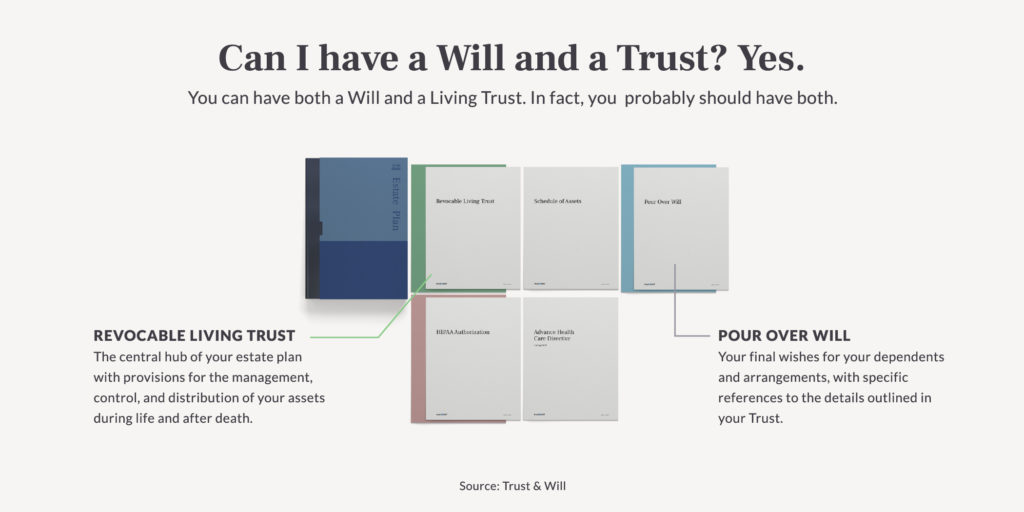

Is it better to have a will or a trust in the UK? The choice between having a will or a trust depends on various factors, particularly the complexity of your estate. For individuals with substantial and intricate assets, possessing both a will and a trust can offer significant advantages. However, it’s essential to emphasize that this decision is highly situational. If you have a relatively small estate with straightforward assets that are easy to transfer, and your wishes are uncomplicated, opting for a basic will might be the most straightforward and efficient approach. The specific circumstances of your estate and your preferences will ultimately determine the best choice for you. This decision should be made in consultation with legal professionals to ensure it aligns with your unique situation and needs. (Published on July 11, 2022)

Does A Trust Avoid Inheritance?

Can a trust help you avoid paying inheritance taxes? The answer depends on the specific type of trust you have. Certain trusts have their own Inheritance Tax rules, which means that once your assets have been successfully transferred into the trust, they are exempt from Inheritance Tax upon your death. However, there are other types of trusts that may incur higher rates of income and capital gains taxes. To navigate the taxation implications effectively, it is crucial to understand the nature of your trust and its associated tax regulations. This knowledge will empower you to make informed decisions regarding your estate planning and the potential tax benefits or liabilities your trust may entail.

Discover 24 Are trust wills a good idea

:max_bytes(150000):strip_icc()/living-trust-68520a8be0eb4438a99c95ff1483a19a.jpg)

Categories: Details 27 Are Trust Wills A Good Idea

See more here: khoaluantotnghiep.net

Learn more about the topic Are trust wills a good idea.

- Will vs. Trust: What’s the Difference?

- Disadvantages of will trust – set up a life time trust – Bluebond

- What is the Difference Between a Will and a Trust?

- Using a trust to cut your Inheritance Tax – MoneyHelper

- Putting a House In a Trust – Is It Worth it? – Nottingham Central – Belvoir

- How Much Money Do You Need to Set up a Trust in the UK?

See more: khoaluantotnghiep.net/travel